*disclaimer: Not financial advice. This is my personal trade plan only. I am not qualified or licensed to advise anyone on their specific positions or trades, I am sharing my personal opinions only. Never make financial decisions based on any information on this site or any associated platforms. Always consult a professional for investment related advice and do your due diligence*

Overview:

A lot happened today. Indices gave back yesterday’s gains with some sharp sell offs. This was not the structure down that bulls wanted to see. As group members saw, I did not add more long exposure on today’s dip – in fact I took off some longs at breakeven. There are several possibilities open ahead of OPEX tomorrow. In today’s update I will be breaking down a few of the top scenarios.

The KEY to answering “what’s next?” is the structure of the next move… Allow me to explain:

BULLISH SCENARIO

- Before panicking, note that the bull counts (see yesterday’s newsletter) are still valid. The main issue is the aggression shown by sellers in today’s move down – especially on $NQ

- For this scenario to hold up the next move needs to be an impulsive bounce with a corrective retrace (5 up, 3 down)

- Essentially what the bulls are looking for is a 1,2 off the lows

- $ES found support at the 21day EMA + .618 fib. The structure into the zone was a little sharp, but viewed alone this looks fine for the bulls.

- The real issue here is $NQ. The move down was aggressive and appears impulsive (rather than a corrective wave 2). Buyers did step in to save it at the .887 but there is a lot of work to be done to repair this structure.

- The biggest advocate of the bull case is $YM. The Dow Jones has shown relative strength over the last 2 weeks and continued to do so today. Bulls want to see continued strength from $YM in hopes that it can drag the rest of the market up with it

- $AAPL has been the leader of big tech since November. If tech is going to recover and keep the bull count intact, $AAPL must show strength again. Its very possible today was the completion of w4 but we need to see follow through tomorrow as confirmation

- $AMZN found support at the .618 today. If tech bulls are going to show up, this is the spot

BEARISH SCENARIO

- If the bulls fail to produce an impulsive bounce, these bear alts come into play.

- What the bears are looking for is a corrective bounce with an impulsive rejection from key fibs

- Of course, the lack of any bounce at all (and a break below yesterday’s lows) would be bearish as well

- The good news for bulls is that $YM does not share this same look

- $NQ is the biggest advocate of the bear case. There is very little room for weakness before this bear alt takes over

Technically speaking there is one more scenario – expanded flat 2’s. If yesterday’s lows are taken out very slightly (without breaching the 12/03 lows) and bulls find a strong and impulsive reversal nearly immediately… then the 3rd alt comes into play. I find this to be low probability, my focus is on the two scenarios given above

If I had to choose, I’d give the bulls the edge. But until some confirmation is found I will remain patiently waiting…

Setups:

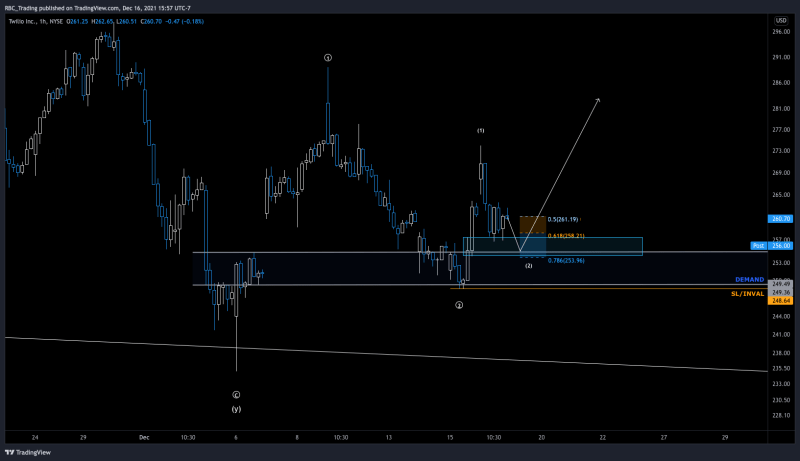

- Setup: 1,2-1,2

- Confluence: Demand zones

- Trigger: 2H Reversal from fib zone

- Conditions: Bullish scenario on indices

- Notes: If the bulls prevail on the indices, this is the first place I’m looking. I expect to see a test of the .786 tomorrow based on AH action. If a strong reversal is found there I will look for longs

- Setup: B-1,2

- Confluence: Trendline/Fib confluence

- Trigger: 4H Reversal from fib zone

- Conditions: Bonus if indices are bearish, but not required