*disclaimer: Not financial advice. This is my personal trade plan only. I am not qualified or licensed to advise anyone on their specific positions or trades, I am sharing my personal opinions only. Never make financial decisions based on any information on this site or any associated platforms. Always consult a professional for investment related advice and do your due diligence*

I’ll admit, today was really fun… Who doesn’t like a 150pt rejection from a key level?… HOWEVER, this is no time to sit back and claim victory – there is still a ton of work to be done to capitalize going forward. Today was a great start for the bears, but we still have a massive FOMC day tomorrow. Stay focused, stay vigilant, stay nimble.

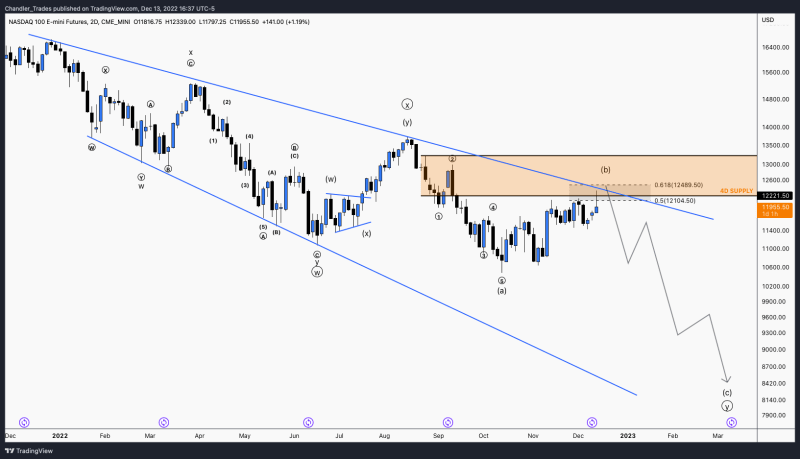

HTF Context:

- High timeframe context unchanged. Great rejections from the fibs/trendlines/supply zones today.

What happened today?

- Price ripped through the December highs just ahead of the cash session today, fueled by a cooler (but still high) CPI of 7.1%. This took the indices right into a major area of interest and the reaction did not disappoint. Price turned lower into the cash session and ended up retracing the entire CPI move by the afternoon.

What do the bears need next?

- Today was a good start for the bears, but there is still plenty of selling needed to get the indices to the October lows and beyond. The next major step for bears is to take out last week’s lows and print a significant impulse down into the holidays. This would officially flip the mid term trend back down, in line with the macro downtrend.

Is the top in?

- I received this question multiple times today, rightfully so. My answer isn’t as definitive as most of you (and myself) would like it to be… I think the top is probably in, but I don’t have enough information to say so with any certainty. FOMC tomorrow is a wild card. I’m guessing it will be more of a bearish event than a bullish one, but there is still a level of caution required.

The first step towards ‘confirming’ the top would be to complete this impulse down off the premarket high. This requires accepting a w(1) leading diagonal that is a bit murky, but it formed during the CPI volatility and has the right structure, so I’m going to run with it for the moment. Bears need to find a w(5) down from here and take out the recent low of 4017. Wave (4) could sneak a bit higher but it does not need to – in fact, it would be more ideal if price took a more direct path down for w(5).

If price breaks above 4100 before reaching today’s low, this count is invalidated and the argument for the top being in is greatly weakened.

If this impulse prints, the argument for the top being in will be significantly bolstered.

Plan for tomorrow:

- My plan for tomorrow will begin late tonight. I am planning on trading the overnight session from about 1am-4am EST with the goal of catching the w(5) down. Assuming that w(5) comes, I will then be looking for a corrective bounce towards overhead supply into FOMC. A corrective arrival to supply would constitute a proper swing setup. I almost never hold risk into major events such as FOMC, but tomorrow may be an exception IF things set up properly. My risk will be managed extremely carefully in this situation. If price does not move according to plan, I will stick to intraday scalps and stay sidelined for FOMC.

- Remember, this action is all happening from a key high timeframe location… Price is forming an impulse down through a key pivot and I’m looking for a corrective retrace – AKA a reversal structure. This structure is coming from 4D supply within the context of the macro wave count. If you do not understand the significance of this paragraph, please re-watch the video pinned at the top of this newsletter.

Swings:

- $MSFT overshot 4H supply by a bit, but quickly reversed and closed below. I will be looking for opportunities to get short on both $MSFT and $LULU following FOMC (if things go as planned for the indices).

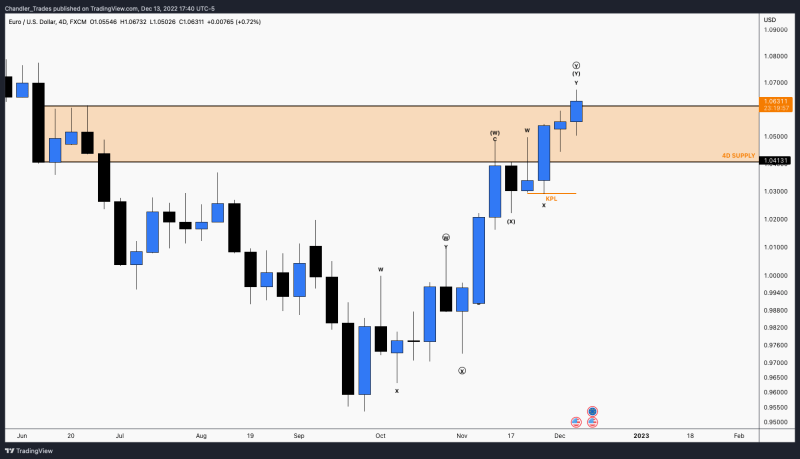

Forex:

- Still monitoring $DXY and the Euro… $EURUSD is peeking above 4D supply, but still has tomorrow until the candle closes. Powell could very easily spark a reversal in these two tomorrow – If he does, I would consider it a major form of confluence for the counts on $ES and $NQ.