Chandler Trades

What is Elliott Wave Theory?

Elliott Wave Theory is the idea that equities and other trade-able assets move in series of repeating patterns. The concept was first introduced by Ralph Nelson Elliott in the 1930’s and has since become a popular method of technical analysis among investors. These patterns are based on investor psychology. In the modern era of trading many trading algorithms are based on the Elliott Wave structures and Fibonacci numbers. Elliott Wave analysis allows traders to find the potential paths an asset may follow. When used properly traders can identify high probability reversal locations with minimal risk.

The Basics:

The Elliott Wave structure follows the pattern “5 up, 3 down”

Waves 1,3,5 are known as ‘impulse’ or ‘motive’ waves. Impulse waves always move with the trend

Waves 2 and 4 are known as ‘corrective’ waves. Corrective waves always move against the trend

Each wave in the structure is comprised of a smaller version of the pattern. This subdivision is theoretically infinite, and can be observed on any time scale.

The concept of subdivision can be visualized below. Each wave and sub-wave can be broken down into smaller versions of the structure.

Wave (1) is an impulsive wave comprised of a 5 wave structure labeled i-ii-iii-iv-v. Each of these waves subdivides into a smaller structure

Wave (2) is a corrective wave comprised of a 3 sub-wave structure labeled a-b-c. Each of these waves subdivides into a smaller structure

Rules:

Elliott Wave follows a few rules. These rules, with the exception of one, can NEVER be broken. If your wave count violates any of these rules, the count is incorrect and must be re-evaluated.

- Wave 2 can never drop below wave 1’s low

- Wave 3 can never be the smallest wave

- Wave 4 can never enter into the range of wave 1 – unless it is part of a diagonal

There are many guidelines in Elliott Wave which I will discuss shortly. It is important to understand the distinction between a rule and a guideline – Rules must ALWAYS be followed. Guidelines are USUALLY followed, but will not necessarily always apply.

Fibonacci Numbers

Elliott Wave measurements are based on Fibonacci ratios. The Fibonacci sequence is an arithmetic sequence in which the next number is simply the sum of the previous two numbers in the sequence (0, 1, 1, 2, 3, 5, 8, 13, 21…etc). This sequence and its derivatives are commonly observed in nature, mathematics, psychology and yes, even financial markets. I could ramble for hours about all the fascinating connections within this sequence but for the sake of time I will keep it related to the markets. First, some common ratios and very important numbers to make note of:

- The ‘Golden Ratio’ 1.618 and 0.618

- Divide any number (greater than 1) in the sequence by its successor (example, 13/21=0.619) or the predecessor (example, 13/8=1.625)… the average across the sequence will come out to be right around 1.618 (or 0.618) and is more exact with larger numbers (example 144/89=1.61798)

- 2.618 and 0.382

- Divide any number greater than 1 in the sequence by its successor +1 (example, 8/21=0.381) or the predecessor -1 (example 34/13=2.615). The average among the entire sequence will be 2.618 or 0.382

- 0.618 squared also happens to be 0.382

- 1.272 and 0.786

- The square root of 1.618 is 1.272

- The square root of 0.618 is 0.786

With these numbers in mind, notice how they connect to common wave retracements and extensions (write these down, you will use them a lot):

- Wave 2: Common retracement levels

- 61.8%-78.6% of wave 1 (golden zone, most common)

- May also be 38.2%, or 50%

- Usually retraces at least 50%

- Wave 3: Common extension levels

- 161.8% extension of wave 1 (most common)

- May also be 127.2%, 200%, 261.8%, 361.8%

- Wave 4: Common retracement levels

- 38.2%-50% of wave 3

- May also be 14.6%, 23.6% (sometimes 61.8%, but it must not retrace below the wave 1 top)

- Wave 5: Common extension levels

- 50%-61.8% extension of waves 1-3

- 161% of wave 4

- Equal to the length of wave 1

These ratios and levels are seen consistently throughout Elliott Wave structures. Keep them in mind as we break down the specifics of each structure

Impulse Waves:

Impulse waves are waves 1,3 & 5. They always move with the trend and are typically momentum movements.

Each impulse wave can be subdivided into 5 waves of a lower degree. If there is no 5 wave subdivision, it is not an impulse wave.

Impulse Measurements:

- Wave 2: Usually a 50%-78.6% retrace of wave 1

- Wave 3: Measured as an extension of wave 1 starting from the bottom of wave 2…. common extensions are 1.272, 1.618 (most common), 2.0, 2.618, 3.618

- Wave 4: Usually a 38.2%-50% retrace of wave 3

- Wave 5 is measured as an extension of waves 1-3 from the bottom of wave 4… common extensions are 0.618 (most common), 1.0, 1.618

- Additionally, wave 5 is often equal in length to wave 1, especially when wave 3 ends at the 1.618

Extended Waves:

In most cases, one wave within an impulse ends up being an extended wave. Usually this is wave 3, but that is not always the case. Waves 1 and 5 are capable of become extended, although it is less common. The extended wave(s) can be identified through the sub-waves.

One way to identify extended waves early is to look at the sub count. If an impulse wave breaks the high of the previous wave but fails to reach the minimum target before a corrective pullback, it is likely the start of the extended wave.

Corrective Waves

For an Elliott Wave trader, understanding corrective waves is crucial. This is where the money is made (or lost). There are several types of corrective patterns that will be covered, so take some time to carefully study these patterns.

The basic corrective pattern is usually 3 waves, labeled ABC. However, there are many ways in which these 3 waves can subdivide.

Zig-Zags:

Zig zags are the most common corrective waves, and subdivide in a 5-3-5 pattern. Waves A & C will be impulsive in nature and B will be a 3 wave corrective pattern.

Take note of the 5-3-5 subdivision of the main ABC structure

In a zig-zag, wave B typically retraces 50% to 61.8% of wave A… Wave C usually finishes in the 1.0-1.27 extension range of wave A

In some cases, wave B may be a triangle.

Flats:

There are several different types of flat corrections. The structure of a flat correction is 3-3-5

Regular Flat (most common):

The typical flat follows the 3-3-5 pattern, and has a ‘flat’ appearance, hence the name.

Wave B usually retraces most of wave A, although it is a common misconception that this wave must retrace at least 90%. The only requirement of the B wave is that it subdivides into 3 waves.

Wave C usually has a 1.0-1.618 extension of wave A.

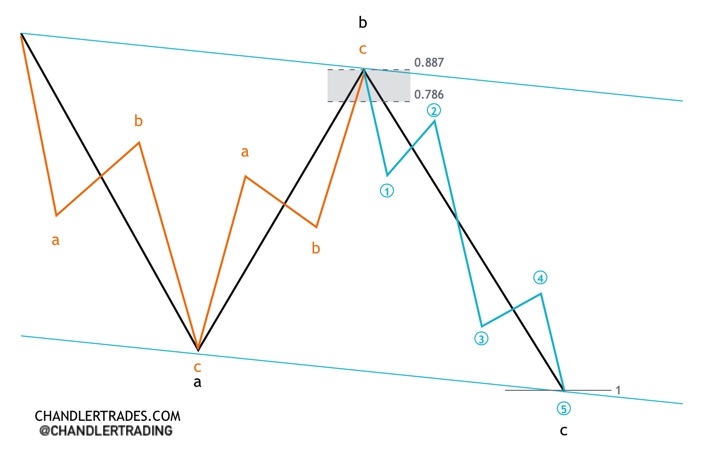

Expanded Flat (less common):

The expanded flat also has a 3-3-5 structure. The difference in an expanded flat is that wave B will break above the origin of wave A. This will be a ‘false breakout’ and punish traders that chase the move.

Wave B is often 114.6-127.2% of wave A

Wave C is often 1.272-161% of wave A

Expanded flats are often bull/bear traps. Many traders will enter when wave B breaks the wave A high (or low, in the case of a downtrend), only to see five sharp wave reversal for wave C. By identifying wave B as a 3 wave corrective move rather than a 5 wave impulse, Elliott Wave traders can be prepared and avoid this trap.

Running Flat (least common):

The running flat is the least common form of the flat correction. It is very similar to an expanded flat, but wave C is cut short

Take note of the channel that is formed by a running flat.

Running flats can often be confused for a 1,2 set up, making it important to recognize wave B’s 3 wave structure which hints that the correction is still in progress.

Triangles:

The triangle correction is the only corrective pattern that does not follow the 3 wave pattern. Triangles are based on 5 waves, labeled A-E. Each wave will have a corrective structure . Wave E has the tendency to either over or under-shoot the A-C trend line.

Triangle corrections can NOT occur alone as a wave 2. They may only occur as a stand alone wave 4. If a triangle appears in a wave 2, it must be part of a combination correction. Triangles may be symmetrical, ascending or declining.

Combination Corrections:

Combination corrections are often called complex corrections, but there is really no need to overthink it. Combination corrections in simple terms: 2 corrective patterns joined together by a counter-trend 3 wave move or triangle.

Combination/Complex Corrections are labeled WXY. The corrections within them are labeled normally (ABC or ABCDE)

Diagonals

Diagonals are impulsive moves that either start or end a structure. In a diagonal, wave 4 will cross into the area of wave 1. This is the only situation in which this overlap can occur. Diagonals are 5 wave moves and can subdivide as either a 5-3-5-3-5 or 3-3-3-3-3 structure.

Diagonals can only form in a few locations:

- Leading Diagonals: Wave 1 of an impulse, or Wave A of a correction

- Ending Diagonals: Wave 5 of an impulse, or Wave C of a correction

- Diagonals cannot form in any other locations

Diagonals typically end in a violent fashion. They often appear as wedges, one of the most explosive patterns. If you are able to identify a diagonal before it ends, you will have a chance to catch a strong move.

Geometry

Elliott Wave structures often coincide with more ‘traditional’ technical analysis patterns such as wedges, channels, flags, etc. Here are a few examples of ‘traditional’ T.A and Elliott Wave analysis may be combined:

Channels:

Impulse waves frequently form channels. Once waves 1-3 are formed, draw the channel to connect both tops and pass through the wave 2 low. The lower bound will extend to help locate a possible support for wave 4. This can also be effective in finding the wave 5 extension.

Pitchforks:

Pitchforks, similar to channels, can help find support and resistance levels for each wave. A pitchfork is drawn using 3 points: the origin of wave 1, the end of wave 1 and the bottom of wave 2. Pitchfork median lines are also a useful tool in finding support and resistance in sub-waves.

Head & Shoulders:

The Head & Shoulders (and inverse head and shoulders) patterns are quite common in Elliott Wave. Often, the patterns are found at reversals. In the example above, an inverse head and shoulders pattern is found as the corrective ABC pattern ends, and an impulse begins with a 1,2 move.

Wave Psychology

Elliott Wave Theory was developed with trader psychology as the primary consideration. Each wave has its own associated psychological characteristics, as follows (assume bullish trend):

- Wave 1: Hope/Relief/Skepticism

- Wave 1 is always the first move following a correction. This wave is often met with feelings of relief and hope that the downtrend is over. There is also a level of skepticism to this first bounce and its sustainability.

- Wave 2: Dread/Worry/”Here we go again”

- Wave 2’s are the ones that shake most investors out before a rally. Since there is only one wave up since the correction ended, wave 2 is often seen as one that may continue the downtrend. Investors often panic sell on this deep retracement out of fear of downside continuation

- Wave 3: Confidence/Optimism/FOMO

- After wave 2 makes a higher low, wave 3 displays investors’ new confidence that an uptrend has started. Traders and investors often chase this higher-high breakout. Shorts are squeezed in this process. Wave 3 is often the strongest wave because of this.

- Wave 4: Questioning/Lingering Doubt

- Wave 4 is the wave where some investors begin to question the rally again. “Has the run finished? Are we heading back down now? Should I take profits?”

- Often, wave 4 is more shallow than wave 2 due to the higher level of confidence following wave 3

- Wave 5: Euphoria

- In this wave, everyone is bullish. Investors feel invincible and believe the market will rise forever… Late comers buy into the highs after a strong rally. Wave 5 completes the 5 wave structure with a bang!

Applying Elliott Wave Analysis

KEY POINTS:

– Elliott Wave is an effective tool, not a crystal ball

– Projections don’t always turn into trade setups

– Trade setups don’t always turn into trades

– Form a thesis. Allow price to confirm/disprove your thesis. Act accordingly

Elliott Wave can be a very effective tool… But like any tool, it is only as effective as the person using it.

Using Elliott Wave the right way can be very profitable. Using it improperly can be devastating to your account and drain your mental capital. Unfortunately, there are many traders with large followings that misrepresent EWT and how it should be used.

Let’s take a look at what Elliott Wave really is and is not:

Proper EWT IS….

- A form of analysis used to provide high probability possibilities

- Based on an objective set of rules and guidelines

- Best used in conjunction with other methods of analysis

- Constantly adjusting with price

Proper EWT IS NOT…

- A perfect system that predicts price movement with complete accuracy

- A representation of a trader’s bias

- To be used alone and relied solely upon to ‘predict’ future price action

- A rigid and unchanging prediction model

When developing an Elliott Wave count, it is important to follow all rules and ensure that each wave properly subdivides. Failure to do so will result in you projecting your bias onto the chart.

- There are some popular ‘fintwit’ accounts on twitter that are guilty of this. Please beware of half complete Elliott Wave counts that call for an outrageous fulfillment of their bias, usually in the form of total economic collapse or unrealistic upside. These accounts are very poor examples of EWT and do a disservice to the community.

Trading with Elliott Wave:

Every trade should start with a conditional statement:

If Price does _______________ then it is highly probable that the outcome will be _______________

Elliott Wave analysis will give you one or more potential paths that an asset may take. The goal is to narrow down these possible paths to the one that is most probable. This becomes your primary projection. However, you cannot simply assume your projection is correct.

Once you have your main count/projection, it is your job to determine what price action will confirm that you are (probably) correct. This requires multi-timeframe analysis. In order to enter, you are looking for lower time frame price action to confirm your higher time frame projection.

If A, then B. If X, then Y.

No guarantees. No guessing.

Form a thesis –> Wait until price supports/disproves your thesis –> React accordingly.

Conclusion

Congratulations! If you have made it this far, you now have every tool needed to be a successful Elliott Wave trader. From here, apply the things you have learned and practice counting waves. With repetition the patterns will become more and more clear. Thank you for taking the time to read and support my work, I wish you the best in all your trading endeavors!

If you found value from this guide and are interested in more content, consider some of my other resources:

Twitter | Memberships | ALISD + Chandler Trading Course